The Science of Debt Recycling: Strategies for Building Wealth and Reducing Debt

Debt is a common issue that many people face, but it doesn’t have to be a lifelong burden. With the right knowledge and strategies, you can not only reduce your debt but also build wealth in the process. One such strategy is debt recycling, a financial concept that has gained traction in recent years. In this article, we will explore the science behind debt recycling and how it can be applied to improve your financial situation.

Understanding the Concept of Debt Recycling

Debt recycling is a financial strategy that involves leveraging your existing debt to invest in assets that generate an income. The basic principle behind debt recycling example is to use the income generated from the assets to pay off your debt faster, while simultaneously building wealth. This approach can be particularly advantageous for individuals who have a substantial amount of non-tax-deductible debt, such as credit card debt or personal loans.

The Basic Principles of Debt Recycling

Debt recycling operates on the principle of using your existing debt to create additional wealth. By repurposing your non-tax-deductible debt into tax-deductible debt, you can reduce the overall cost of your debt and free up more funds for investment. The goal is to create a positive cash flow from the income generated by the invested assets, which can then be used to pay down the debt faster.

When implementing debt recycling, it is important to carefully consider the types of assets you invest in. Ideally, you want to choose assets that have the potential to generate a consistent income stream. This could include rental properties, dividend-paying stocks, or even a small business venture. By selecting the right assets, you can maximize the income generated and accelerate the debt repayment process. Click here to get more about the Sydney financial advisor.

One key advantage of debt recycling is the potential tax benefits it offers. By converting non-tax-deductible debt into tax-deductible debt, you may be able to claim deductions on the interest payments associated with your investments. This can help to reduce your overall tax liability and increase the amount of money available for debt repayment or further investment.

How Debt Recycling Differs from Other Financial Strategies

Debt recycling differs from other financial strategies, such as debt consolidation or debt refinancing. While these strategies aim to consolidate multiple debts into a single loan with lower interest rates, debt recycling focuses on using the income from investments to accelerate debt repayment. The emphasis is on building wealth while reducing debt, which sets debt recycling apart from other approaches.

Another key difference is that debt recycling requires a proactive approach to managing your finances. It involves actively seeking out investment opportunities and monitoring the performance of your assets. This level of involvement may not be necessary with other strategies, such as debt consolidation, where the focus is primarily on restructuring existing debt.

It is important to note that debt recycling may not be suitable for everyone. It requires careful planning and consideration of your financial goals and risk tolerance. Additionally, it is essential to seek professional advice from a financial advisor or planner who can assess your individual circumstances and provide tailored recommendations.

In conclusion, debt recycling is a financial strategy that allows individuals to leverage their existing debt to invest in income-generating assets. By repurposing non-tax-deductible debt into tax-deductible debt, individuals can reduce the overall cost of their debt and use the income generated from investments to pay off debt faster. Debt recycling differs from other financial strategies by focusing on wealth creation while reducing debt and requires a proactive approach to managing finances. It is important to carefully consider your financial goals and seek professional advice before implementing debt recycling.

The Science Behind Debt Recycling

The success of debt recycling hinges upon understanding the role of interest rates and the impact they can have on your financial health. By harnessing the power of compounding interest, debt recycling has the potential to generate substantial wealth over time.

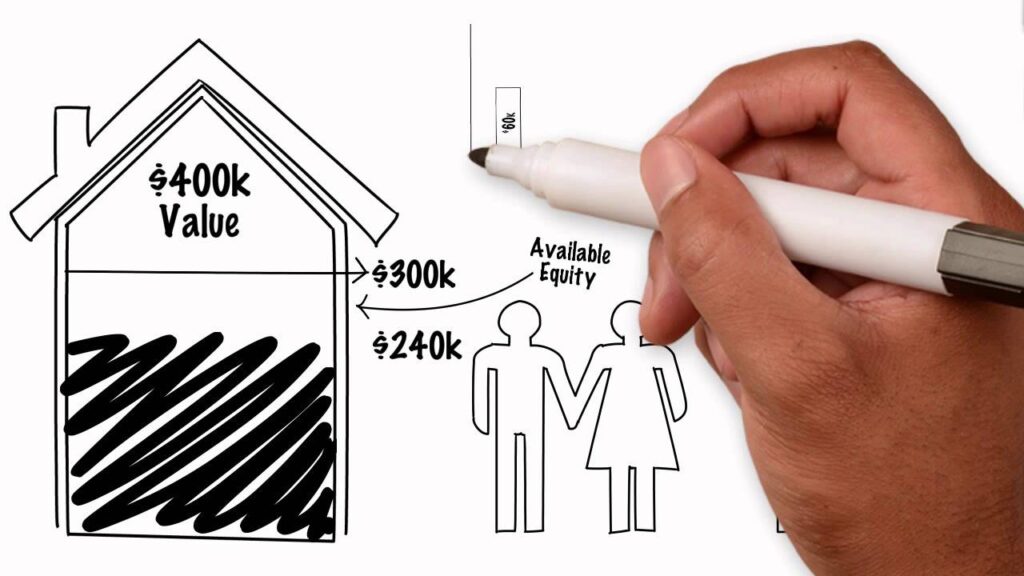

Debt recycling is a financial strategy that involves using the equity in your home to invest in income-generating assets, such as shares or property. The goal is to use the income generated from these investments to pay off non-deductible debt, such as a mortgage or personal loan, while simultaneously building wealth through the growth of your investment portfolio.

One of the key factors in the success of debt recycling is the careful management of interest rates. Interest rates play a crucial role in debt recycling. By targeting the highest interest rate debts first, you can effectively minimize the overall interest paid over the long term. This strategy allows you to save money on interest payments and accelerate the repayment of your debts.

The Role of Interest Rates in Debt Recycling

Interest rates can have a significant impact on your financial situation. When it comes to debt recycling, understanding how interest rates work is essential. The higher the interest rate on a debt, the more you will end up paying over time. By redirecting your cash flow from the income-generating assets towards these high-interest debts, you can expedite their repayment.

For example, let’s say you have a mortgage with a high-interest rate and a separate investment loan with a lower interest rate. By using the income generated from your investments to pay off the mortgage, you can save money on interest payments and reduce the overall amount of interest paid over the life of the loan.

Furthermore, by strategically managing your debts and taking advantage of lower interest rates, you can potentially save thousands of dollars in interest payments. This can free up more money to invest and accelerate the growth of your investment portfolio.

The Impact of Debt Recycling on Financial Health

Debt recycling can have a significant impact on your overall financial health. By reducing your debt load and increasing your investments, you can position yourself for long-term financial success. The key is to carefully manage your debts and investments to ensure that you are maximizing your returns and minimizing your costs.

One of the benefits of debt recycling is the ability to deduct the interest incurred on the investment debt. This can further enhance your financial position by reducing your taxable income and potentially saving you money on taxes. However, it is important to consult with a financial advisor or tax professional to fully understand the tax implications of debt recycling in your specific situation.

Additionally, debt recycling allows you to build wealth over time through the growth of your investment portfolio. By using the income generated from your investments to pay off non-deductible debt, you can effectively reduce your overall debt load and increase your net worth. This can provide you with greater financial security and flexibility in the future.

In conclusion, debt recycling is a powerful financial strategy that can help you reduce your debt, increase your investments, and position yourself for long-term financial success. By understanding the role of interest rates and carefully managing your debts and investments, you can harness the power of compounding interest and generate substantial wealth over time.

Implementing Debt Recycling Strategies

Implementing debt recycling strategies requires a careful assessment of your financial situation and the selection of the right approach for your needs.

Debt recycling is a financial strategy that involves repurposing non-tax-deductible debt for investment purposes. By doing so, individuals can potentially reduce their overall debt while simultaneously building wealth through investments. However, before embarking on a debt recycling journey, it’s important to understand your current financial situation and make informed decisions.

Assessing Your Financial Situation

Before diving into debt recycling, it’s crucial to take stock of your existing debts and evaluate their terms and interest rates. This assessment will help you determine the amount of non-tax-deductible debt that can be repurposed for investment. By understanding the specifics of your financial obligations, you can make more informed decisions about how to proceed.

Additionally, assessing your overall financial health is essential. Consider factors such as your income, expenses, and savings. Understanding your cash flow and financial stability will help you determine if debt recycling is a suitable strategy for your situation.

Choosing the Right Debt Recycling Strategy

There are several debt recycling strategies to consider, each with its own set of benefits and considerations. It’s essential to evaluate your risk tolerance, investment goals, and time horizon to select the most suitable approach.

One common debt recycling strategy is using a home equity loan or line of credit to invest in income-generating assets. This approach allows individuals to leverage the equity in their homes to access funds for investment purposes. However, it’s crucial to carefully consider the risks involved, such as potential fluctuations in property values and interest rates.

Another strategy involves refinancing existing non-tax-deductible debt with a tax-deductible loan. By doing so, individuals can potentially reduce their overall interest costs and redirect those savings towards investments. However, it’s important to carefully assess the terms and conditions of the new loan to ensure it aligns with your financial goals.

Consulting with a financial advisor can provide valuable guidance in making the right decision. An experienced professional can help you analyze your financial situation, assess the various debt recycling strategies available, and tailor a plan that aligns with your unique circumstances and goals.

Remember, debt recycling is not a one-size-fits-all solution. It requires careful consideration and a thorough understanding of your financial situation. By taking the time to assess your circumstances and consult with professionals, you can implement a debt recycling strategy that helps you reduce debt and build wealth over the long term.

Risks and Benefits of Debt Recycling

Like any financial strategy, debt recycling comes with its own set of risks and benefits that should be carefully weighed before implementation.

Potential Risks in Debt Recycling

One potential risk of debt recycling is the possibility of investment losses. Investing in the market carries inherent risks, and if the invested assets do not perform as expected, it could negatively impact your overall financial position. It’s important to conduct thorough research and seek professional guidance to mitigate these risks.

The Benefits of Effective Debt Recycling

The benefits of effective debt recycling are numerous. By converting non-tax-deductible debt into tax-deductible debt, you can potentially lower your overall cost of borrowing. The income generated from the invested assets can be used to accelerate debt repayment, ultimately reducing the time it takes to become debt-free. Additionally, the growth of your investment portfolio can contribute to long-term wealth accumulation and financial security.

The Future of Debt Recycling

As financial strategies continue to evolve, it’s important to stay informed about the latest trends in debt recycling.

Predicted Trends in Debt Recycling

Experts predict that debt recycling will become an increasingly popular strategy as individuals seek innovative ways to manage their debt and build wealth. In an ever-changing financial landscape, staying up-to-date with the latest developments can help you maximize the potential benefits of debt recycling.

How to Stay Updated on Debt Recycling Strategies

Staying updated on debt recycling strategies can be accomplished through various means. Subscribing to reputable financial publications, attending seminars, and consulting with financial advisors can provide you with the knowledge and insights needed to make informed decisions and successfully implement debt recycling strategies.

In conclusion, debt recycling offers a unique approach to address both debt reduction and wealth building. By understanding the science behind this strategy and implementing it effectively, individuals can optimize their financial health and position themselves for long-term success. With careful planning, assessment, and ongoing education, debt recycling can be a powerful tool for individuals seeking to build wealth and reduce debt simultaneously.